NEWS

August 2023 on the markets

US equities declined in August with the Dow Jones, S&P500 and Nasdaq Composite losing 1,77%, 2,36% and 2,17% respectively. The dollar gained 1,38% against the Euro to close at 1,0841 USD/EUR. Investors' confidence that the Federal Reserve would stop its cycle of raising the interest rate after July's increase took a hit as FED policy makers are divided on the next steps.

During this year's meeting at Jackson Hole, which took place in late August, FED Chairman Jerome Powel made clear that they are prepared to further increase the interest rate should inflation heat up again and that the inflation target remains at 2%. In July core inflation dropped a modest 0,1 percentage point to 4,7% year-over-year, while overall inflation (which includes food and energy) gained 0,2 percentage points to 3,2% year-over-year. We expect core inflation to further reduce gradually but overall inflation to remain around the current level with minor up and down movements.

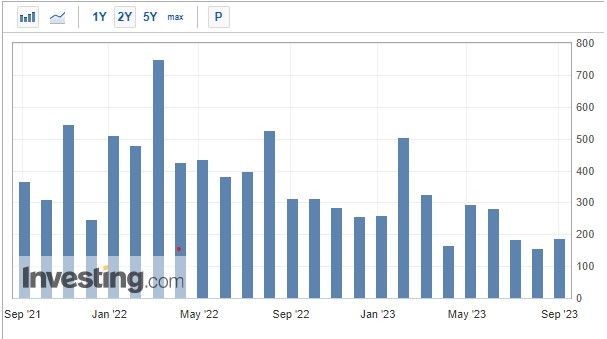

The USA continues to have a robust labor market as the non-farm payrolls added another 187000 jobs in August. On the other hand it must be pointed out that the new jobs being added are in a clear downtrend over the past 2 years as the chart below (source: investing.com) indicates. Also the numbers of new jobs have been strongly revised down for two consecutive months.

Despite more jobs being added, the US unemployment rate unexpectedly jumped from 3,5% to 3,8%. This is not the result of people losing jobs, but rather as a result of a sharp increase in the labour participation rate. The unemployment rate is historically still at a very low level but is beginning to normalize.

Also European markets dropped in August. The DAX, Eurostoxx and CAC40 indices lost 3,04%, 3,90% and 2,42% respectively. The Slovene SBITop index was one of the major losers globally in August, shedding 8,06% to close at 1156,60. The drop was lead by Zavarovalnica Triglav (ZVTG) which lost 14,49%, in part due to the August floods and hail storms in Slovenia. Also Petrol (PETG), which has a 19,44% weight in the SBITop, lost 10,98% in August, although this was largely due to a dividend payment – taking that into account, the share fell by a more modest 4,88%.

Macro-economically there were no significant changes compared to July in the eurozone. Annual inflation was estimated at 5,3% for August, staying stable compared to July, while core inflation, nudged down from 5,5% to 5,3%. Eurozone unemployment remained at 6,4%.

In the UK headline inflation moderated further in July to 6,8%, while core inflation was unchanged at 6,9%. The Bank of England increased interest rates from 5% to 5,25% and warned that rates would need to remain sufficiently restrictive to help tame inflation. UK's FTSE index dropped 3,38% while the Pound Sterling remained virtually unchanged against the Euro at 0,8552GBP/EUR.

Share prices in Hong Kong and China were sharply lower in August as weaker Chinese manufacturing and property sector woes weakened investor sentiment. China has sought to boost confidence in the country’s stock market by cutting stamp duties on share transactions, as well as by cutting the interest rate. The country's post-Covid recovery has been hit by a property crisis, falling exports and weak consumer spending. The Hong Kong Hang Seng index lost 8,45% in August.

The energy sector was the best performing sector in August amid ongoing production cuts from Saudi Arabia and other Opec+ producers. Oil gained 2,24% to 83,63 dollars per barrel.

Gold once again dropped below the key $2000 per ounce level, losing 3,29% to close at 1943,05 dollars per ounce.

Rudy Marchant

Fund manager Primorski skladi